The Unknown Shopper #1: novel behaviors in grocery retail amid the virus

In times where the world as we know it is being turned upside down by the rapid spread of a lethal virus, what we do, how we do and the decisions we used to make will not be the same.

Human behavior is the very first thing that changes and subsequently ripples to all other different areas of our daily lives. And one of those areas that have seen a significant behavioral change is the in-store grocery shopping.

Pre COVID-19, understanding how people shop was already a hot topic for brick-and-mortar Brands and Retailers looking for ways to improve their store execution and the shopper experience. Now, as we are dealing with shopping patterns never before observed, these data become even more relevant for the correct and rapid decision making. By re-focusing their analysis on what drives sales rather than just what was sold, decision-makers can proactively tap into what could have been sold.

Over the last few years, Mediar has become a category leader in realtime in-store behavior analysis for the grocery retail working with top retailers and all the major global Brands. Since the COVID19 outbreak, our data started to churn an unprecedented amount of new shopping behavioral patterns.

Starting today we plan to share on a series of blog posts called “The Unknown Shopper” the latest insights and trends that our customers are being able to capture.

For our first post of the series, we want to steer the attention to one of the most impacted categories — Cleaning Supplies.

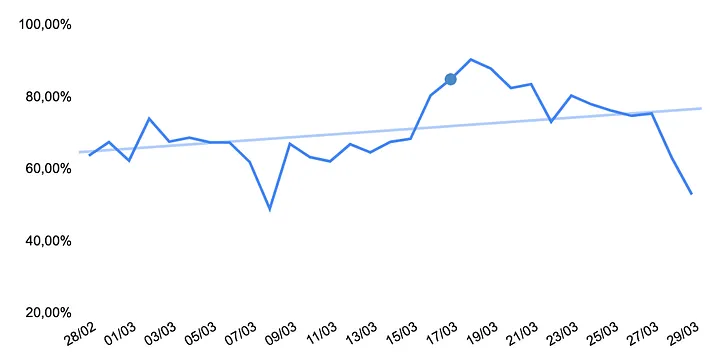

Category aisles traffic flow

After COVID-19 — category traffic flow

The first thing that catches our attention is the shopper traffic flow at the aisles of the store where these products are located. As a comparison, we will analyze data from before and after the first COVID-19 case was reported in the country. In the first chart, we can observe a continuous decrease in traffic, almost 30%, from January to February. However, when the first case is confirmed on February 26th, the curve undergoes a significant inflection point and begins to increase day by day, reaching more than an 80% boost when compared to its highest peak. This is a strong indication that the inventory forecasts that retailers and brands made before the event would no longer be sufficient.

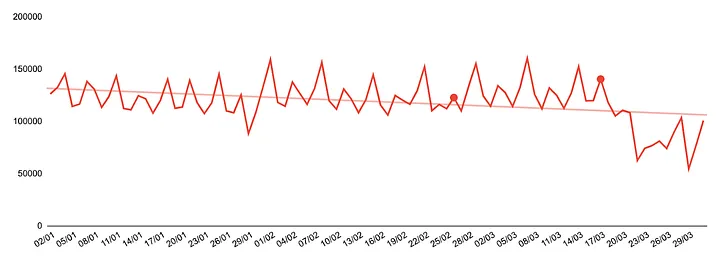

Store traffic flow

Stores traffic flow

Additionally, to make our analysis even more interesting, while the Cleaning Supplies category traffic was going up the overall store traffic was actually declining (-9%) through the same period as we can see o chart above.

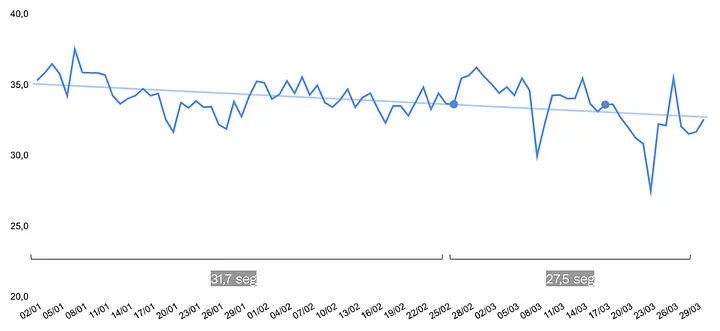

Engagement time in the category

engagement time

Now let’s take a look at the shopper engagement while buying in the category. We can see a meaningful change in the average time spent with cleaning supplies products. It decreased from 31.7s to 27.5s or 13% less, which probably means that shoppers wanted to end their shopping experience as fast as possible to avoid unnecessary environmental exposure. It may also mean that they are less prone to unplanned, discovery shopping.

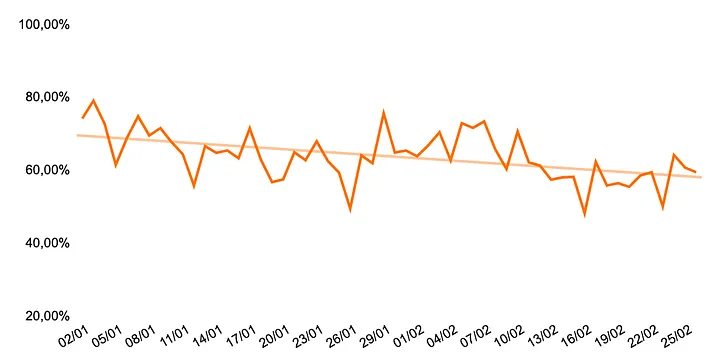

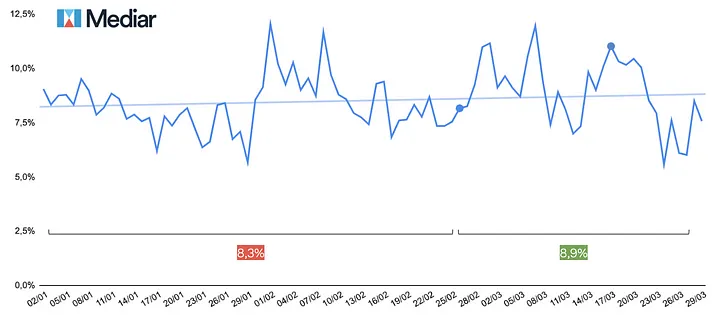

Category conversion rate

Category conversion rate

Last, let’s take a look at the conversion rate. The conversion rate is the percentage of shoppers that have engaged with the products in the category and actually bought it. What is unusual here is that the number has barely changed compared to our beginning-of-the-year benchmark period: 8.9% of engaged shoppers bought one or more products of that same category, compared to 8.3% before the first case. It means that the efficiency of the category in converting a shopper into a buyer hasn’t changed significantly. Still, because of the notable increase in category traffic combined with a more focused category engagement, sales have risen proportionally.

The COVID19 crisis is a very fluid situation, and everyday new patterns are emerging in different categories and parts of the sales floor. Most of our customers are leveraging our realtime behavioral information to make decisions daily, so the shopping experience can be improved and products made available on the shelf when they are most needed.